Most cryptocurrencies traded lower on Thursday, indicating a pause in bullish sentiment.

Bitcoin (BTC) dipped below $47,000, although technicals suggest support around $43,000 could stabilize the pullback. The cryptocurrency also saw a strong uptick in short-term volatility over the past 24 hours, similar to what occurred during bitcoin’s breakout above $45,000 last week, according to data provided by Skew.

Sign up for Market Wrap, our daily newsletter explaining what happened today in crypto markets – and why. Coming April 4.

On Thursday, European Union lawmakers voted in favor of controversial measures to outlaw anonymous crypto transactions. The proposals are intended to extend anti-money laundering (AML) requirements that apply to conventional payments over EUR 1,000 ($1,114) to the crypto sector. BTC fell by 2% within minutes as the vote came through.

Meanwhile, alternative cryptocurrencies (altcoins) underperformed on Thursday, suggesting a lower appetite for risk among crypto traders. For example, ether (ETH) declined by as much as 4% over the past 24 hours, and AAVE lost as much as 9%, compared with a 3% dip in BTC over the same period.

The S&P 500 was also lower on Thursday and snapped a four-day winning streak. Traditional safe havens such as gold and the U.S. dollar rose, while the 10-year Treasury yield continued to decline from Tuesday’s high of 2.5%.

Still, current pullbacks across speculative assets could be limited. Historical data suggests further upside in April and May, albeit with greater volatility because of ongoing macroeconomic and geopolitical risks.

Latest prices

●Bitcoin (BTC): $45,558, −3.13%

●Ether (ETH): $3,286, −3.25%

●S&P 500 daily close: $4,530, −1.56%

●Gold: $1,942 per troy ounce, +0.41%

●Ten-year Treasury yield daily close: 2.33%

Bitcoin, ether and gold prices are taken at approximately 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information about CoinDesk Indices can be found at coindesk.com/indices.

Adding bitcoin to the mix

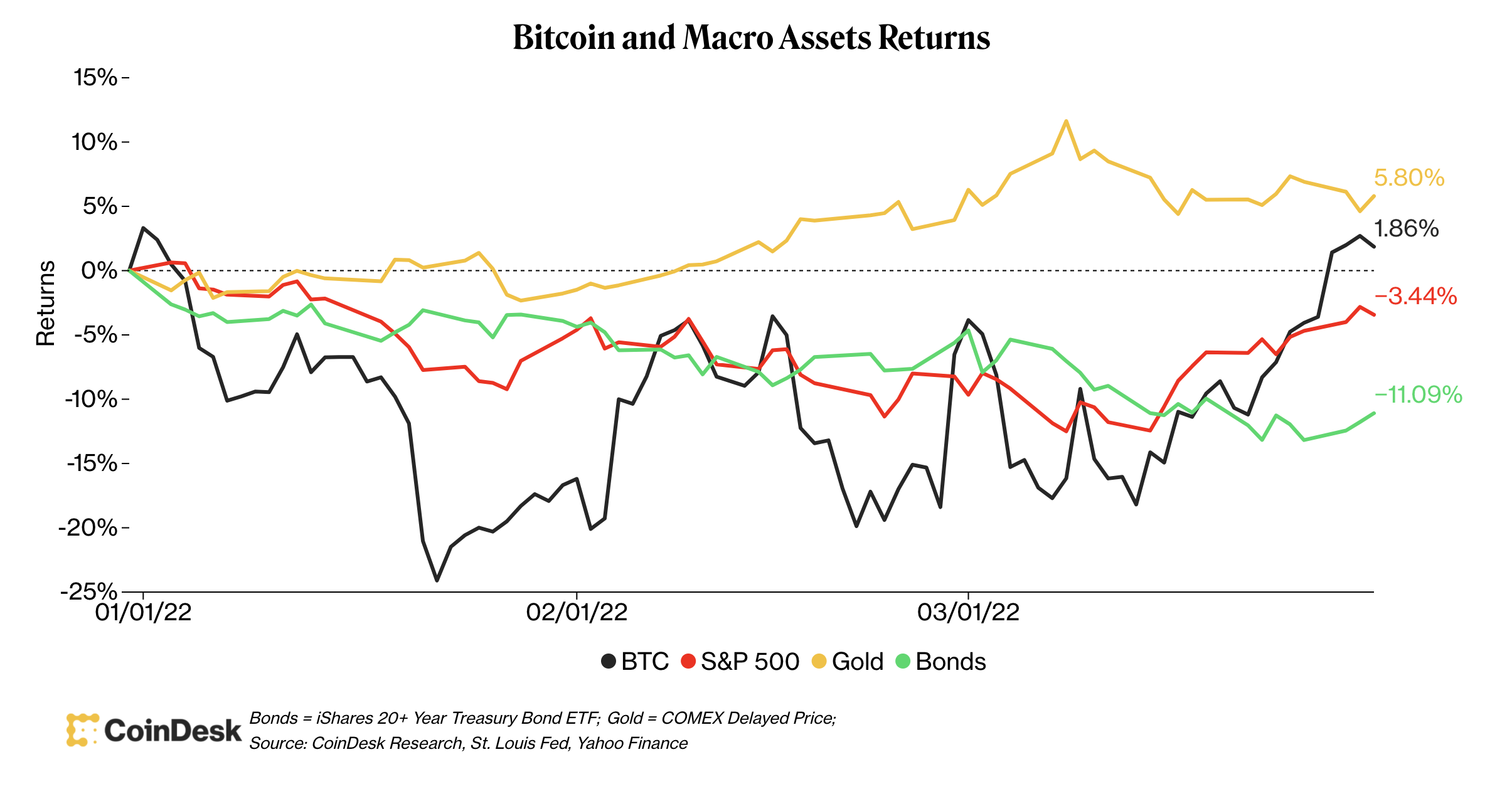

Bitcoin is outperforming the S&P 500 so far this year, albeit with higher volatility.

On a risk-adjusted return basis, however, bitcoin is slightly below the S&P 500 over the past 30 days, according to data from IntoTheBlock. Generally, over time, crypto investors are compensated for higher volatility in the form of higher returns versus traditional equities.

For some investors, diversification has been challenging over the past few months because of bitcoin’s rising correlation with stocks. Further, negative returns in Treasury bonds and stocks contributed to a lower appetite for risk among global investors.

Still, gold and other commodities outperformed over the past three months, which is typical during times of rising volatility and higher inflation.

Altcoins in the lead

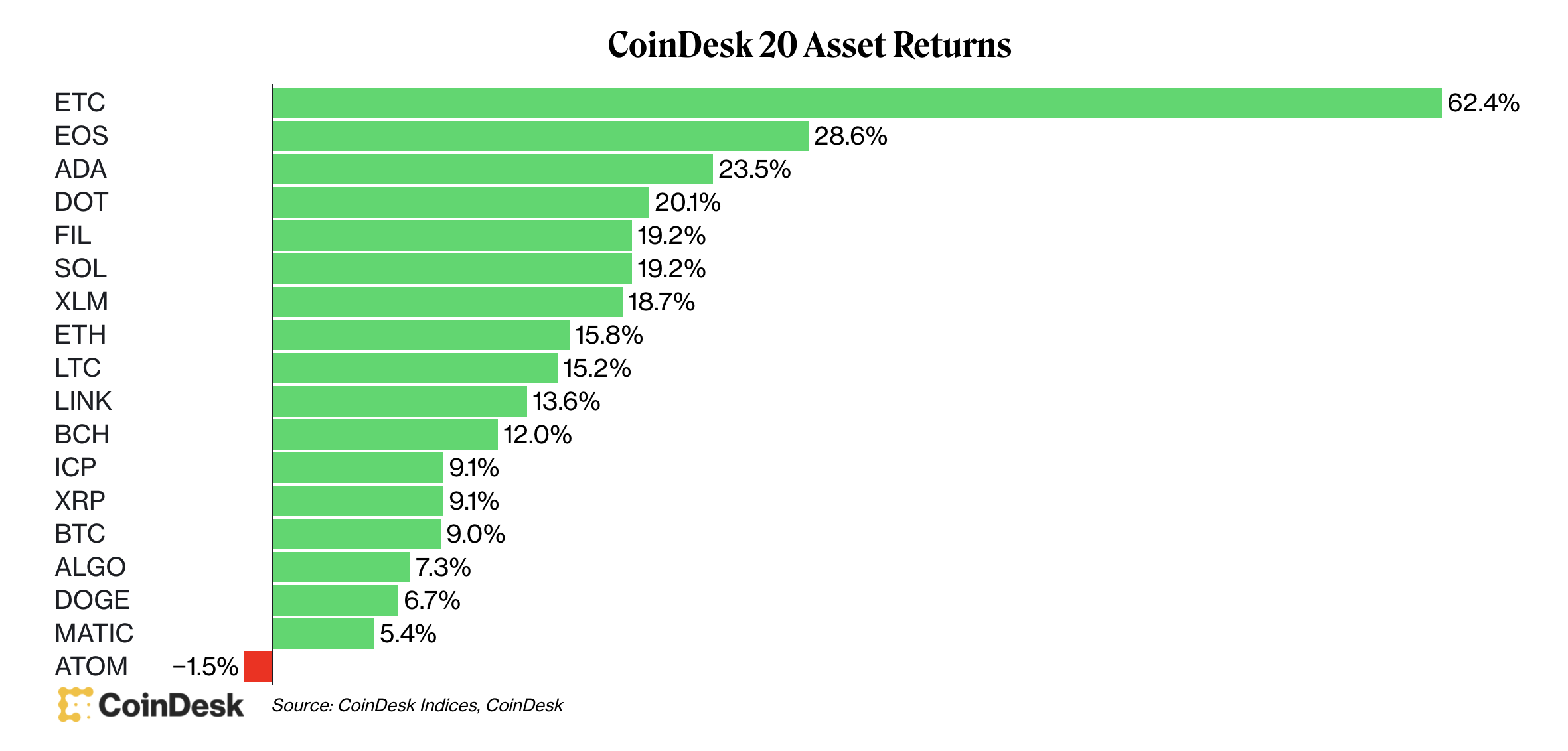

The chart below shows returns across the CoinDesk 20 in March. The CoinDesk 20 filters from the larger universe of thousands of cryptocurrencies and digital assets by trading volume and market capitalization.

ETC, the native cryptocurrency of Ethereum Classic, a blockchain project that was created in 2016 when Ethereum’s blockchain split into two separate chains, posted the highest return in the CoinDesk 20 in March. Meanwhile, ETH was up 15% in March, compared with a 9% gain in BTC over the same period.

Typically, altcoins outperform in a rising market because of their higher risk profile relative to BTC.

Seasonal strength in April and May

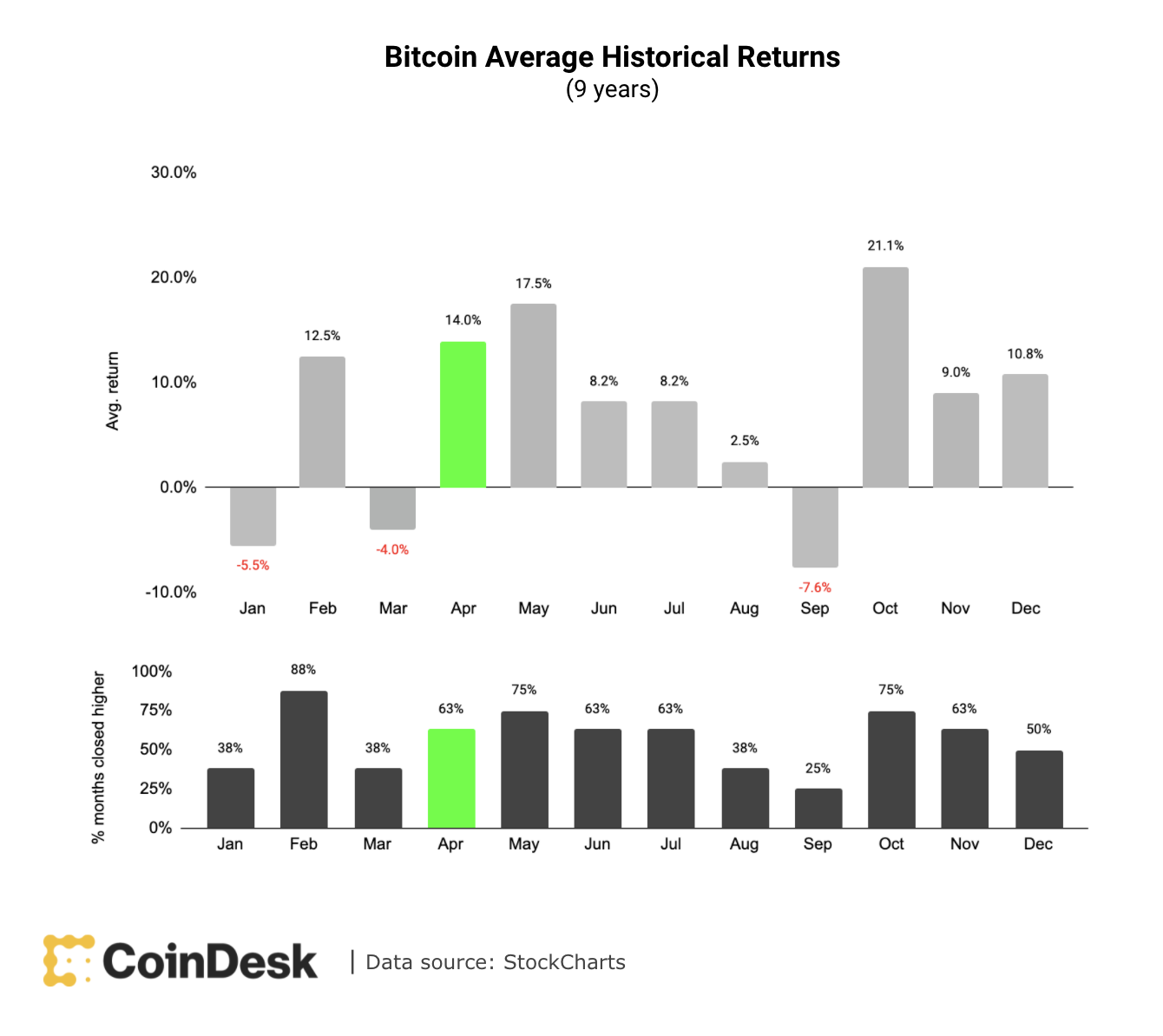

So far, bitcoin’s positive return in March is well ahead of its seasonal norm. On average, March is typically a weak month for BTC, albeit with a low probability. Instead, April and May have a strong probability of positive returns.

The chart below shows bitcoin’s average historical returns alongside the percentage of times when BTC produced a positive return by month. Still, historical returns are no guarantee of future returns, especially during times of war and unprecedented monetary policy.

Altcoin roundup

-

Iconic launches World’s First EOS ETP: The Iconic Physical EOS ETP will be listed and begin trading on European stock markets in the coming weeks. The ETP will be a simple and cost-effective way for investors to gain exposure to EOS, the blockchain protocol based on the cryptocurrency EOS, on European stock markets with a total expense ratio of 0.95%, according to an email from Iconic Funds.

-

Shiba inu’s metaverse will feature more land plots: Developers behind popular meme cryptocurrency shiba inu (SHIB) have unveiled details of their virtual reality project “SHIB: The Metaverse,” announcing 100,595 land plots, some of which will remain private. Developers have decided to use Ethereum’s native cryptocurrency, ether, as a land pricing token, according to CoinDesk’s Omkar Godbole. Read more here.

-

BNY Mellon to custody assets backing Circle’s USDC stablecoin: BNY Mellon, one of the oldest U.S. banks and one of the first to lean into custodying digital assets, will serve as the “primary custodian” for the reserve assets behind the USDC stablecoin, its issuer Circle Internet Financial said Thursday. The relationship likely carries publicity upside for both financial brands, according to CoinDesk’s Danny Nelson. Read more here.

Relevant reads

-

EU Parliament Passes Privacy-Busting Crypto Rules Despite Industry Criticism: Lawmakers are set to end even the smallest anonymous crypto transactions, and plan measures that could see unregulated exchanges cut off.

-

Fed’s Preferred Inflation Gauge Up 6.4% in February to Four-Decade High: Bitcoin remained roughly flat after the release of the Labor Department’s report.

-

Crypto Industry Mobilizes Against Proposed EU Transparency Rules: Crypto advocates were able to sway lawmakers against a provision that could have effectively banned bitcoin in the European Union. Can they do it again?

-

Russia Sanctions Could Spur Use of Crypto: IMF’s Gopinath: Gita Gopinath, the first deputy managing director at the IMF, says the Ukraine conflict could promote the wider use of crypto.

-

CFTC Chief Says FTX Plan Could Make Crypto Markets ‘More Efficient’: CFTC Chair Rostin Behnam said he didn’t yet support FTX’s proposal to directly settle margined crypto trades, but said he must support “responsible innovation.”

Other markets

Digital assets in the CoinDesk 20 ended the day lower.

Largest winners:

| Asset | Ticker | Returns | Sector |

|---|---|---|---|

| Solana | SOL | +1.8% | Smart Contract Platform |

Largest losers:

| Asset | Ticker | Returns | Sector |

|---|---|---|---|

| Internet Computer | ICP | −5.8% | Computing |

| Litecoin | LTC | −5.7% | Currency |

| XRP | XRP | −5.3% | Currency |

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to provide a reliable, comprehensive, and standardized classification system for digital assets. The CoinDesk 20 is a ranking of the largest digital assets by volume on trusted exchanges.